Blulogix Whitepaper

Billing automation: 3 Challenges Tangling Up Your Finance Department

Like many other departments, finance teams are facing complicated struggles in a quickly changing world, yet they’re contending with unique challenges all their own. Whether it’s the rapid evolution of technology, recurring revenue complexities, growing attrition rates or the wake of the global pandemic’s effect on personnel, finance teams have a rocky road ahead. Unfortunately, it will only become even more challenging for organizations that aren’t implementing adaptive solutions. It’s a tangled mess but enterprises can find a solution if they pull the right thread.

Table of Contents

So what are the three big challenges most finance departments need to unravel?

The People Problem

Hiring and staffing, in today’s dynamic world, have become the primary obstacles for finance departments. The job market is in shambles, retaining staff has become increasingly difficult, qualified candidates are wanting to work from home when you need them in the office, and it’s impractical and costly to hire over-qualified billing administrators to simply enter data all day.

Aside from the struggle of keeping up with new demands for billing and invoicing with recurring revenue, hiring more people to throw at the problem — in today’s job market — is simply not a tenable solution.

In the face of these issues, many finance teams are asking, “How can we automate?” Leveraging automation instead of more personnel can alleviate many of these problems. When organizations can automate repetitive and lower-value work, like extracting, copying, and inserting data, filling in forms, and completing routine analyses and reports, they free themselves up to be more productive and find innovative ways to impact their bottom line.

Advanced billing automation can even perform cognitive processes, like interpreting data, automating workflows, understanding unstructured data, and applying advanced business rules to make complex billing decisions.

The Data Problem

It’s critical for companies to be agile in the digital age but finance needs access to up-to-date data to accurately forecast and run scenario planning, in order to support leaders across the business who maintain this agility. But 49% of finance departments don’t feel confident in easily reporting on month-to-date spending at a moment’s notice, let alone that their month-end close numbers are 100% accurate. So, why is that?

Disparate data is why. The finance team, naturally, has the best overall view of the business, however, working with so many different tools, processes, and data sources inhibits transparency and a single source of truth.

This is where automation can not only take mundane tasks off finance’s plate — it can also bring information together, to allow clearer visibility and improve performance across the full spectrum of the business.

From procure-to-pay to order-to-cash, automation can help — and automating today can make the biggest impact tomorrow.

The Process Problem

Less than half (46%) of financial executives say they are able to fully execute their responsibilities because of manual, time-consuming processes. The root of this stems from the nature of business evolution over time and a growing portfolio. Each new product brought into that portfolio constitutes a separate process, creating more time-consuming steps.

In order for executives to get their time back from those manual processes that are growing ever more complicated each day, enabling evergreen processes that tackle data variables is the solution. In theory, the variable should not be the process — the variable should be the data. When it comes to making your business processes more simplified, automation is, again, the key.

Any opportunity you can leverage automation to complete mindless steps that would take a human more time to do, it’s worth considering so you can standardize on one process and focus your efforts on innovation.

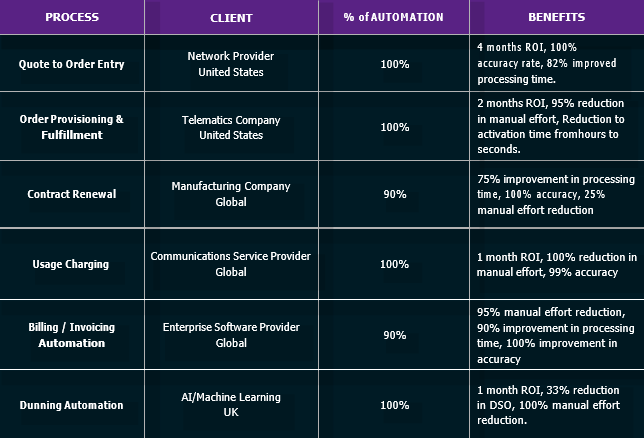

The Automation Solution

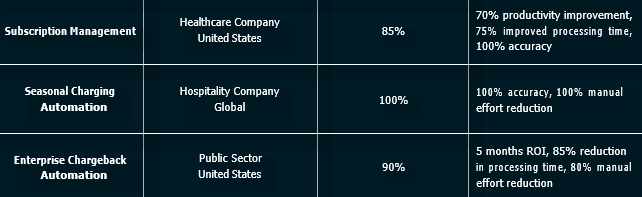

Parsing the people, data and process problems out, it’s evident that there’s a common thread that ties them all together — that thread is automation and it’s the key to getting your finance untangled. The results of finance automation can be dramatic. Take a look at some examples:

Ready to see it in action?

We’ll go over your business case and customize a platform overview tailored specific to your requirements and needs.

Reviews

Michael R.

President, Allnet Air Inc. - Telecommunications

Best Outsourced Billing for Mobility

Karen R.

Manager, Cloud Billing - Computer Software

BluLogix has been a great partner.

“Over the last several years, I have seen continual enhancements and additions to the platform. BluLogix has created a comprehensive solution for users. They provide great communication regarding upgrades and address concerns thoroughly and timely.”

Sara K.

Marketing, Graphic Design & Social Media Management - Marketing and Advertising

Fantastic platform. Recommend!