Dunning & Collections

Reduce Customer Churn Caused by Failed or Delinquent Payments

BluIQ’s Collections & Dunning system provides an advanced framework to manage outstanding debts efficiently. Schedule, tailor, and automate dunning actions based on predefined thresholds to maintain cash flow stability and customer relationships with built-in workflow automation to handle late fees, account suspensions, reactivations, and customer notifications effortlessly.

BluIQ’s automated Collections & Dunning engine helps businesses manage late payments and reduce churn through customized communications and intelligent action triggers.

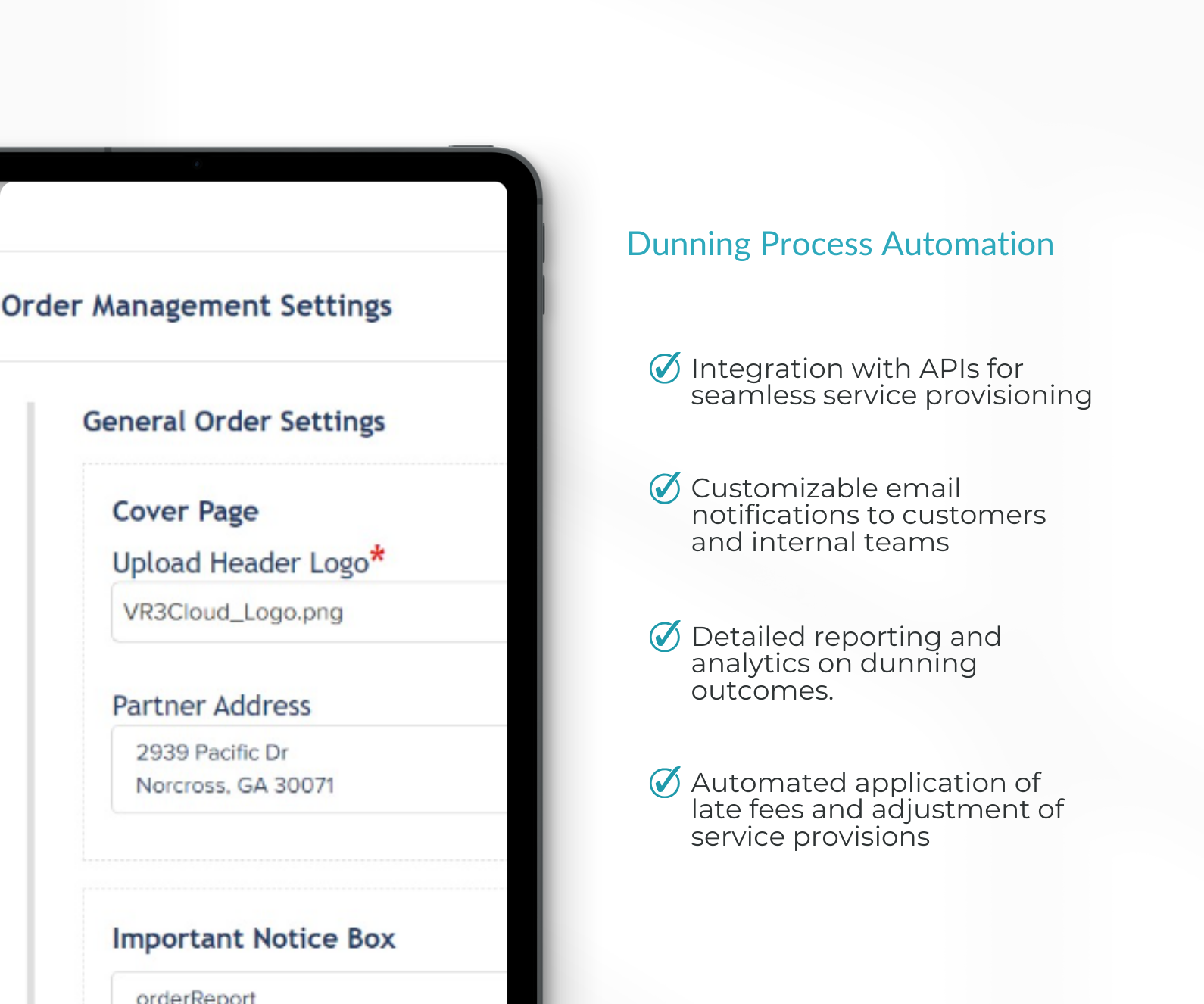

Dunning Process Automation

Efficient Management of Overdue Payments

Automate past-due customer interactions with BluIQ’s dunning and collections to streamline payment recovery, reduce churn, and improve customer relationships with tailored processes. Set custom triggers for invoice aging and account balances to automate communication, apply late fees, or suspend services when needed.

Automatic trigger of dunning actions based on predefined rules.

Integration with APIs for seamless service provisioning.

Customizable email notifications to customers and internal teams.

Detailed reporting and analytics on dunning outcomes.

Automated application of late fees and adjustment of service provisions.

Tailored Customer Interactions

Customizing Communication for Better Results

Create tailored dunning communications that resonate with your customers and encourage prompt payment. Customize message content, timing, and frequency, aligning with customer segments and specific account conditions to improve recovery rates and enhance the customer experience, reducing the risk of churn due to financial disputes.

Configurable message templates for various stages of the dunning process.

Automated escalation for unresolved accounts.

Flexible scheduling of communications based on customer behavior.

Tracking and analysis of communication effectiveness.

Personalized interactions to enhance customer engagement.

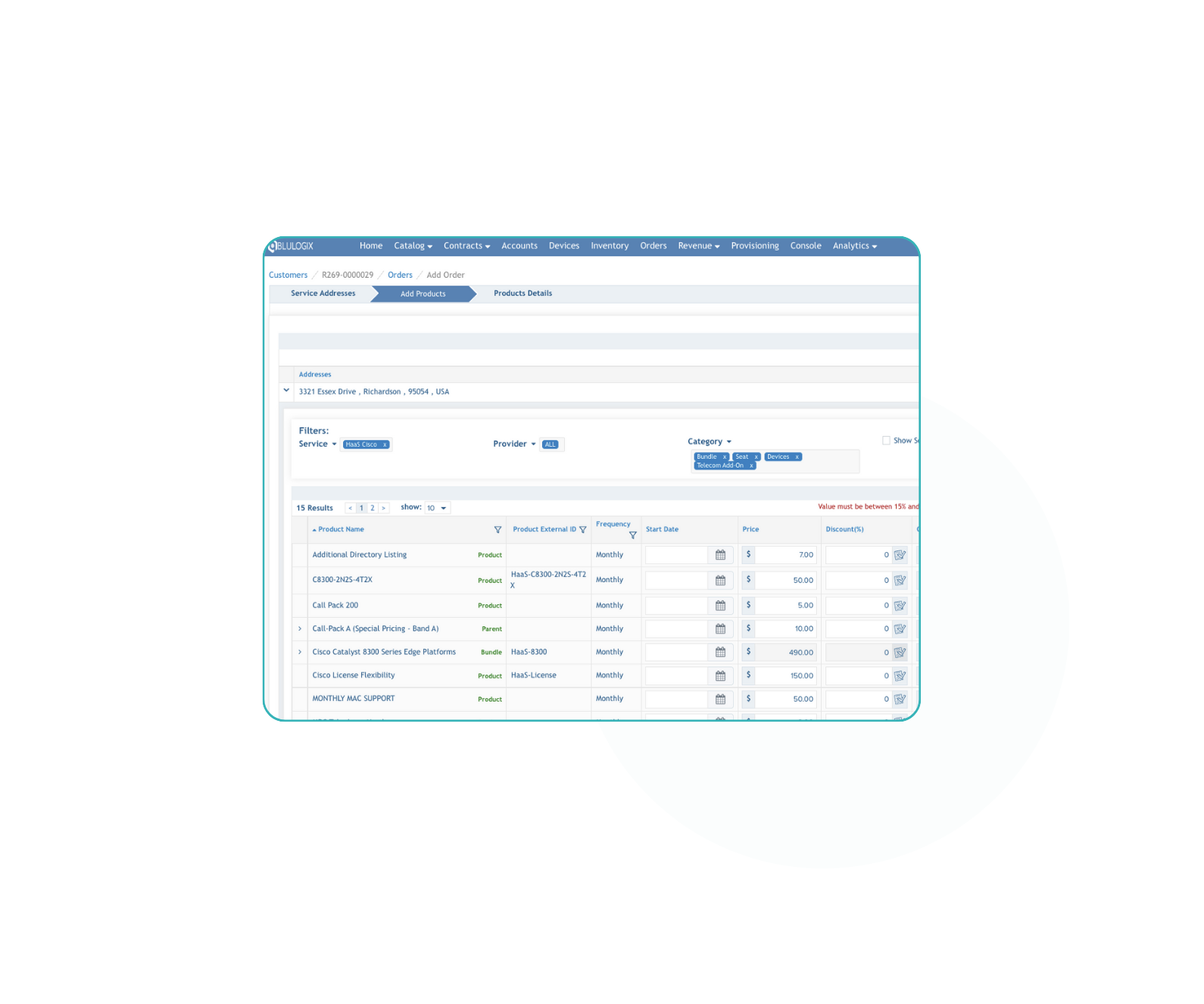

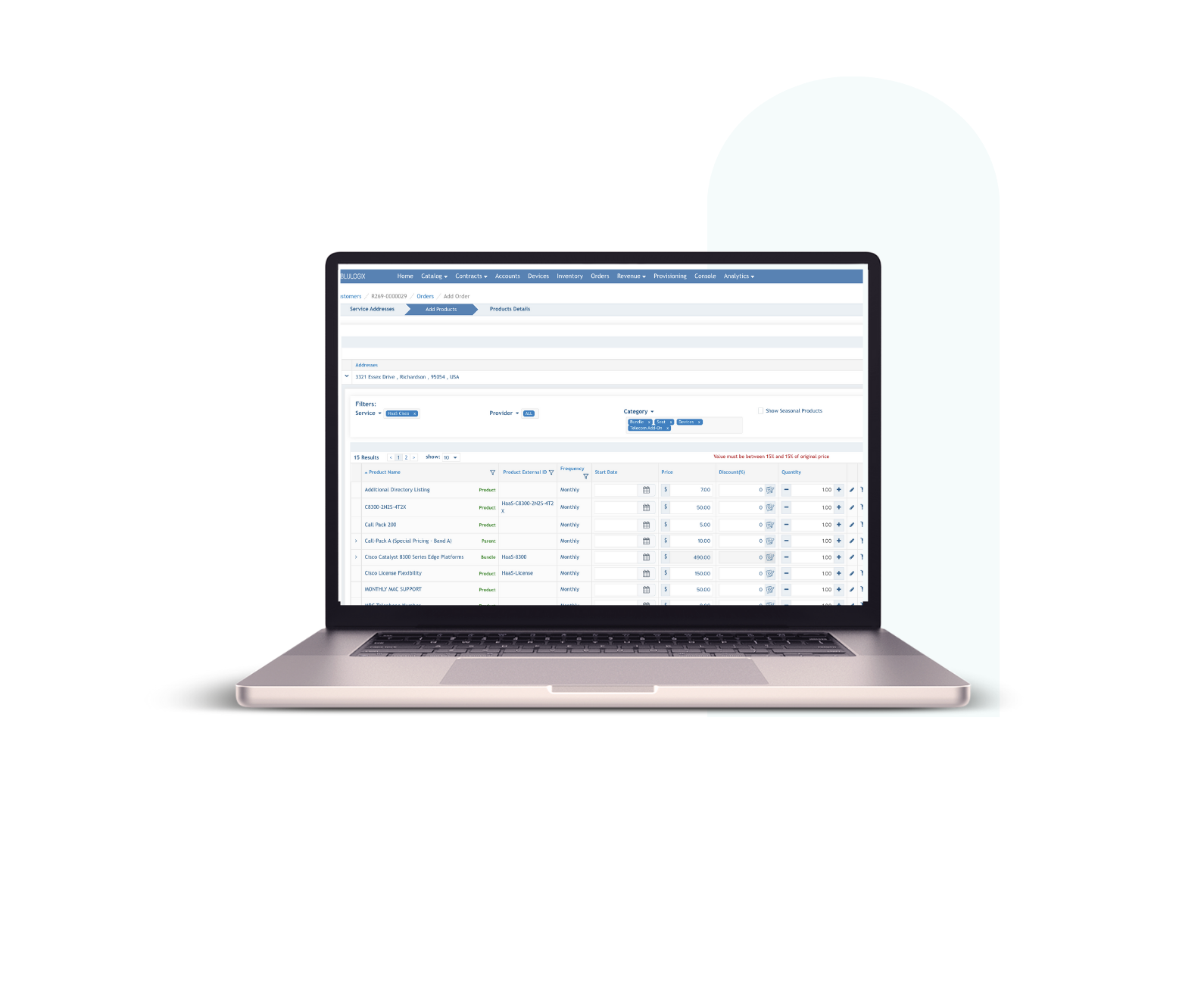

Provisioning and Account Management

Seamless Service Control during Dunning

Manage service activation, suspension, and termination effectively within the dunning process. BluIQ facilitates the seamless integration of service provisioning actions with dunning events, ensuring that all account changes are synchronized with customer payment behaviors, ensuring compliance with contractual terms and maintaining service continuity or interruption based on financial interactions.

Automated service suspension and reactivation linked to payment statuses.

Secure and compliant handling of sensitive account actions.

Direct API integration for real-time provisioning updates.

Detailed logs and records of all provisioning activities.

Customizable actions based on service and contract terms.

Advanced Dunning Strategies

Strategic Approaches to Minimize Debt and Churn

Create and implement tailored dunning strategies with BluIQ’s flexible platform. Develop diverse plans based on customer segments, payment history, and other factors to minimize financial risk while preserving valuable customer relationships.

Design and implement multiple dunning strategies.

Segment-based strategy customization for targeted effectiveness.

Integration of analytics to measure strategy performance.

Real-time adjustments to strategies based on ongoing results.

Comprehensive management of all dunning activities through a unified dashboard.

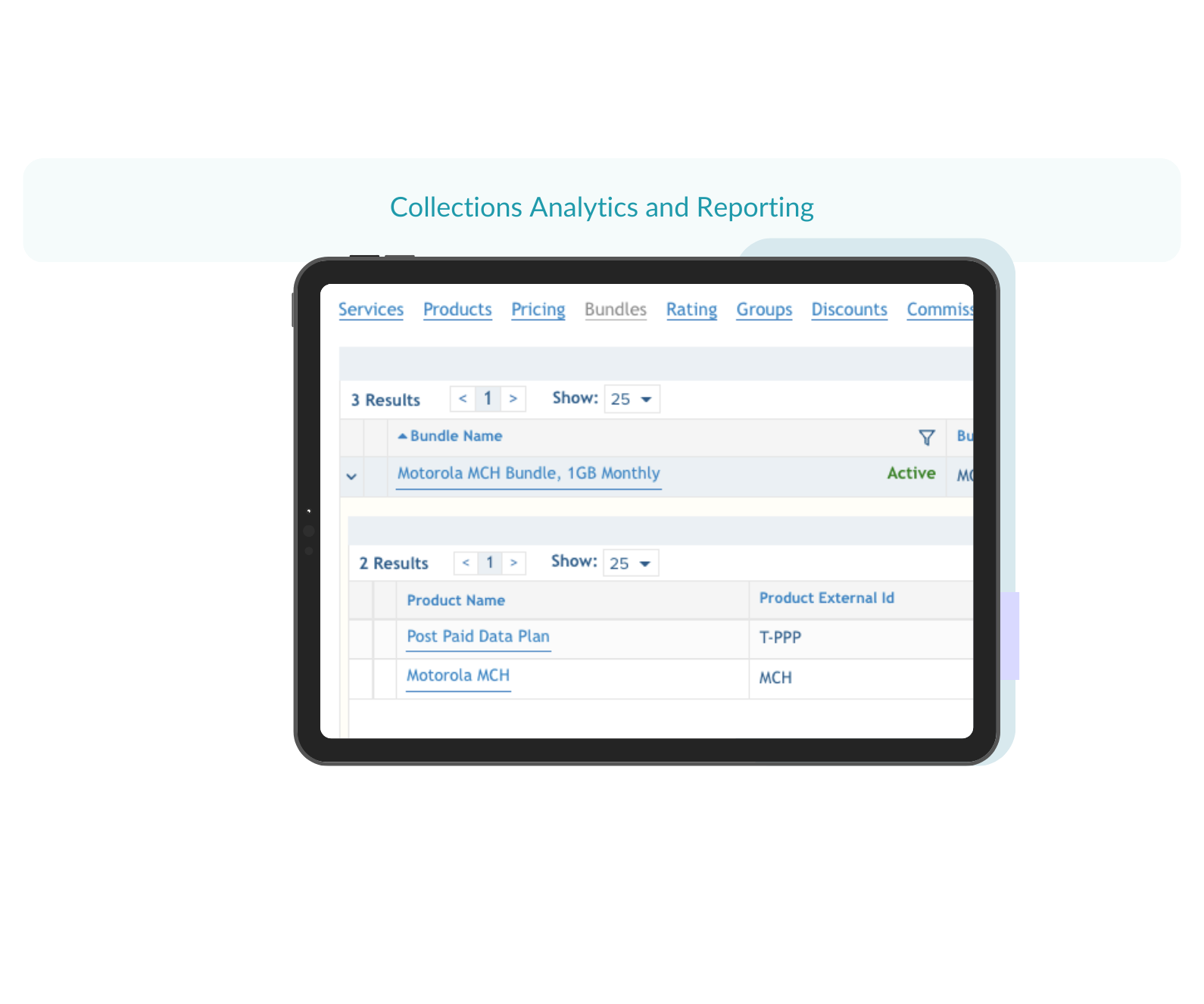

Collections Analytics and Reporting

Insightful Data to Drive Collections Strategy

Use BluIQ’s analytics and reporting tools to assess your dunning and collections efforts. Understand patterns and outcomes to make data-driven decisions, refine strategies, forecast financial outcomes, and improve debt recovery processes.

Real-time analytics on payment behavior and dunning effectiveness.

Predictive analytics to forecast future payment behaviors.

Customizable reports for detailed financial insights.

Tools for continuous improvement of dunning strategies based on data.

Dashboard overviews of aging accounts and receivables status.

Our Customers Love Us

AI and Machine Learning in Agile Monetization: Revolutionizing Billing and Subscription Revenue Models

From Usage to Revenue: Why AI Is Now Required in Modern Billing