Mastering Taxation Management

Navigating Complex Tax Environments with Ease

Global Tax Compliance: Simplify Compliance Across Borders

Staying Ahead of International Tax Regulations

Navigating the maze of international tax laws is a daunting task for any business. BluIQ’s tax management system is designed to handle a wide range of tax requirements, from VAT to GST and beyond, ensuring compliance with regional and global tax regulations. WIth updates in real-time to reflect the latest tax laws, you get peace of mind and freed up resources to focus on core business activities.

Real-time updates for global tax laws.

Reduction of legal and financial risks.

Supports VAT, GST, sales tax, and more.

Simplified management of international tax regulations.

Automated compliance checks.

Integrating with Top Tax Calculation Engines

Automate and Streamline Tax Processes

BluIQ offers seamless integration with leading tax engines like Wolters Kluwer SureTax and CereTax, enabling automatic tax calculations that save time and reduce errors. Ensure precise tax assessments down to the invoice line item level, tailored to the specific tax location rules of your services, ensuring accuracy and compliance in every transaction.

Integrations with Wolters Kluwer SureTax, Avalera and CereTax.

Automated line-item tax calculations.

Customizable tax rules per location.

High throughput and scalability.

Ensures tax rate and rule accuracy.

Advanced Capabilities for Complex Tax Scenarios

Equipped for Sophisticated Tax Requirements

From handling multiple tax rates within a single transaction to managing exemptions and special tax statuses, BluIQ is equipped to tackle complex tax scenarios. BluIQ allows for detailed tax rule configuration and provides robust reporting tools to analyze tax data, helping you make informed decisions about tax strategy and operations.

Multi-rate tax handling.

Powerful tax reporting and analytics.

Configurable for exemptions and special statuses.

Facilitates tax strategy optimization.

Detailed tax rule configurations.

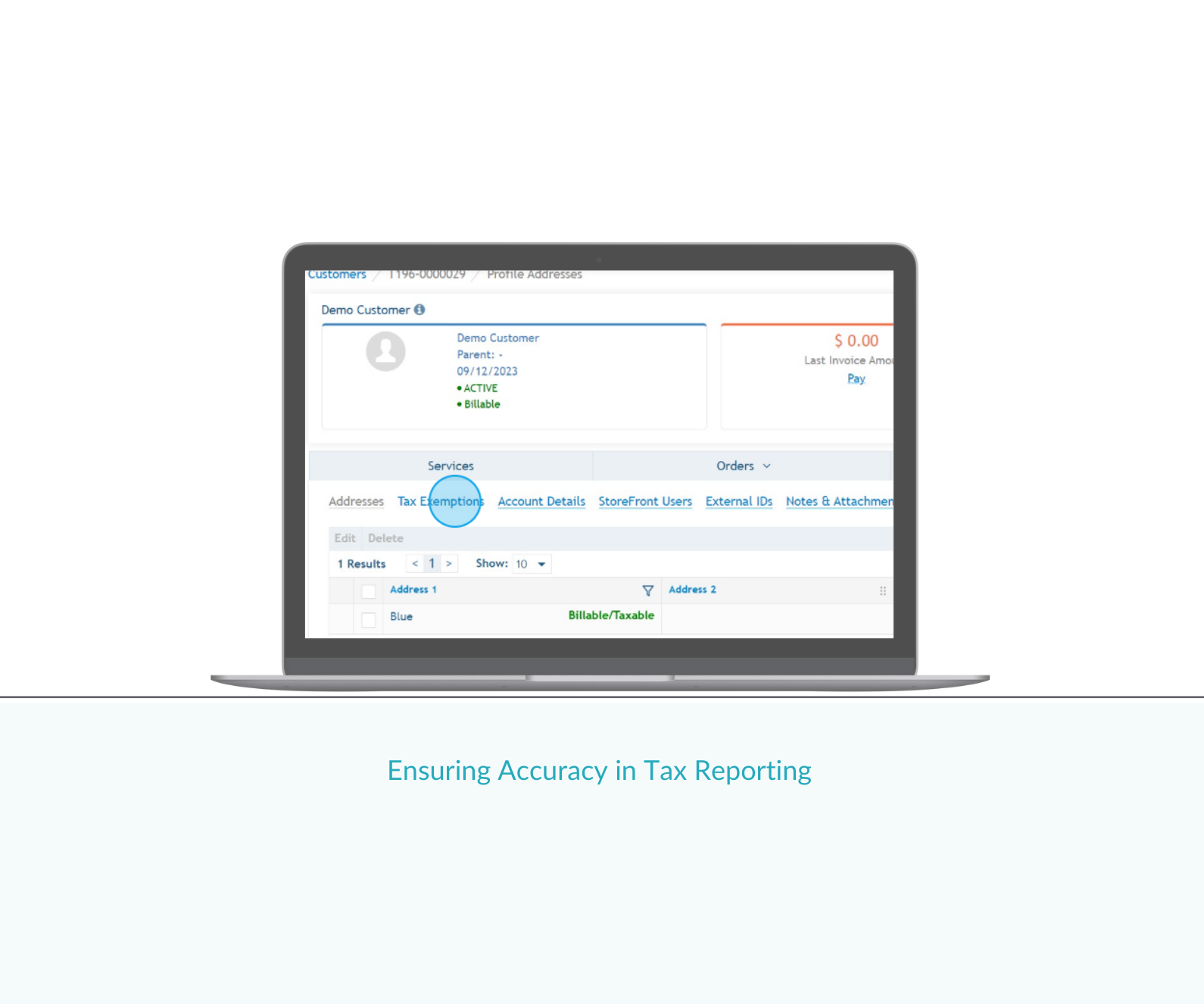

Ensuring Accuracy in Tax Reporting

Reliable Data for Compliance and Insights

Accuracy in tax reporting is critical not only for compliance but also for gaining valuable insights into your business operations. BluIQ’s tax management solution ensures that every piece of tax-related data is accurately captured and processed, providing you with reliable reports for audits, compliance checks, and business analysis.

Accurate tax data capture.

Real-time data processing.

Comprehensive tax reporting.

Insights for business decision-making.

Supports audit and compliance requirements.

Customized Tax Solutions for Every Business Need

Flexible and Adaptable to Your Business Model

Every business is unique, and so are its tax needs. BluIQ’s tax management system is highly customizable, allowing you to set up tax solutions that align to your business model and market dynamics. Whether you need to manage taxes for subscription-based services, e-commerce, or international sales, BluIQ provides the flexibility to support your specific requirements.

Customizable for various business models.

Adaptable to changing business and tax landscapes.

Supports subscription, e-commerce, international sales, and more.

Easy setup and maintenance.

Flexible tax rule configurations.

Our Customers Love Us

From Usage to Revenue: Why AI Is Now Required in Modern Billing

Billing Drift: The Revenue Problem CFOs Rarely See Coming